Nurseries are fast-paced environments where incidents and accidents can happen, even to the most organised and well-ran settings. So whether you are setting up a new nursery or are an established centre, it is essential to know which insurance policies you are required by law to have and which are useful to have.

In this article, we unpick the types of children’s nursery insurance policies available, what to look out for when choosing a nursery policy and highlight the most common accidents to prepare against in your childcare setting.

Why is insurance important in the early years?

Insurance claims can be devastating to a childcare business, new or established. It can damage the reputation of the setting alongside the associated legal expenses of processing the claim.

It is vital that your childcare setting has suitable insurance coverage, covering all aspects of nursery life – from buildings and equipment to public liability. Insurance policies will share how much monetary value they will cover up to if a claim was to be raised; they can sound like large figures.

Take care not to be drawn into what may seem a large amount. £2 million sounds like a substantial figure of coverage at first glance. However, if a child was seriously injured at your setting and your setting was found to be negligent, the compensation the child may receive could be life-long. And that £2 million now becomes insufficient to cover the expenses.

Nursery insurance policies are not used in place of good practice and welfare procedures but to cover the company, contents and employees against any potential damages due to services, accidents and loss of income.

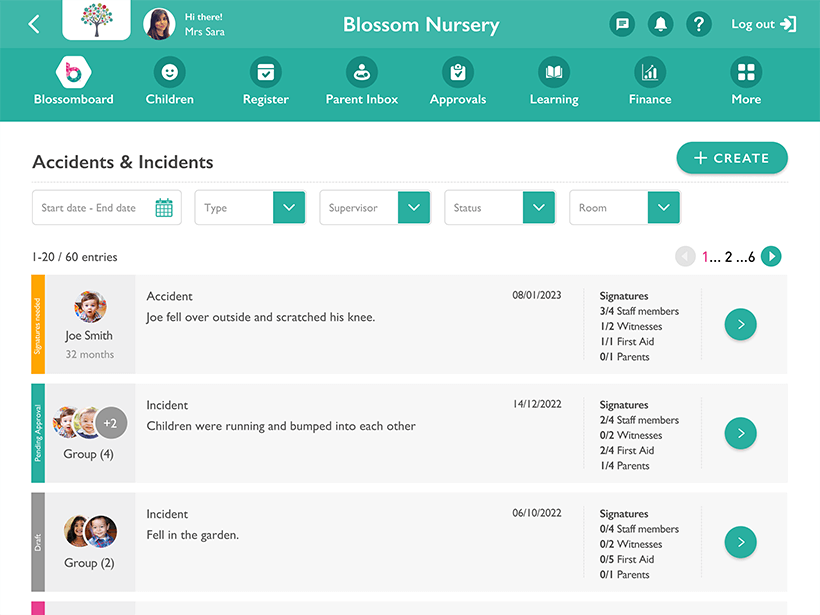

It’s important to evaluate how you are storing all information surrounding first aid incidents at your setting. Keeping a complete record with online accident and incidents forms is essential as it helps managers and owners track any trends or patterns of injury. For example, if there is a specific piece of outdoor equipment that is the cause of a number of minor injuries, a maintenance check may be needed.

What insurance policies can nurseries take out?

Public liability and products’ insurance

All registered childcare settings are required by law to have public liability insurance, including childminders, nannies, preschools, nurseries, and any other setting offering a childcare service.

Public liability covers legal liability in various situations like injury to a child or member of the public (a parent or nursery visitor) or damage or loss to a third party’s property. Public liability insurance is required for any company or organisation that has contact with the general public.

Products’ liability in nurseries is less commonly used but is needed for any childcare setting that sells or supplies products to parents. This could be merchandise like setting-branded water bottles or forest school equipment.

What is employers’ liability insurance in nurseries?

Like public liability insurance, employers’ liability insurance covers claims linked to injury or illness suffered due to the nursery setting. Employer liability insurance is necessary for any location that employs staff, has students training, or uses volunteers.

The price of your policy can differ depending on the number of staff you employ. It is important, to be honest with the number of practitioners (training or qualified) you have onsite at any time; dishonesty can lead to insurance policies becoming invalid, leaving the entirety of the cost of claims on the nursery itself.

Is buildings and contents insurance needed in nurseries?

Unlike public and employers’ liability, buildings and content cover insurance is not a legal requirement for nurseries. A lot of effort and money has gone into your nursery to create a welcoming and learning-rich environment for the children.

Protecting the building, premises and contents of the nursery is therefore a frequently bought insurance for nursery managers and owners.

Building and contents insurance can cover a number of risks, such as flood, storm damage, fires, theft, and accidental or malicious damage. Vandalism can be a larger risk in different areas, if this is something your nursery is affected by, ensure to read the fine print with this type of insurance for nurseries.

If your childcare setting is more likely to suffer from vandalism, it may impact the price you pay for your insurance cover.

Once you’ve taken the time, effort, and cost to set up these policies it’s important to make sure they are easily accessible to your team. Cross-team communication is made much easier by uploading and storing all policies online.

They can be updated any time when necessary, and you can share them easily with your parents as well.

What does business interruption insurance for nurseries cover?

Business interruption insurance for nurseries covers being unable to operate due to several risks, such as flood, fire, storm damage and physical damage to the premises. The insurance covers loss of income and any costs that may have been acquired due to damage to the building through malicious or accidental damage.

Following Covid-19 interruptions to nurseries, it is important to read through what is and isn’t covered through this insurance. A week of nursery closure can be detrimental to annual income; still having to pay your employees wages whilst inconveniencing parents can be challenging to manage. Having financial support to cover for loss of income can help during these unforeseen times.

What non-required nursery insurance policies are useful?

Technical equipment cover in the early years

Your nursery staff may use iPads or laptops to complete their daily child observations or communicate with parents. It is important that these vital pieces of equipment are covered due to accidental damage or malfunction. The product’s warranty can cover this through the supplier, or additional insurance cover can be taken out.

Outdoor equipment insurance for nurseries

Your setting has worked hard to create exciting outdoor learning spaces where the children can explore and learn risk-management strategies. Slips and trips during this exploration stage are expected, but this must be due to the child’s developing balance skills and coordination rather than faulty or unsuitable equipment.

Outdoor equipment is expensive and difficult to repair, especially as it is exposed to all types of weather. Your setting can take out outdoor equipment insurance in case of accidental or malicious damage, also applying to forest school equipment. It can be worthwhile to audit all things health and safety in your setting, including the outdoor equipment.

How are you notified or informed of a first aid incident at your setting? Is it a smooth and reliable process? Using a nursery software with instant notifications allows managers, owners and deputies to be notified immediately- alerting the leadership team of an incident that may result in possible legal claims and giving time to contact insurance companies to gain advice before any potential claim is submitted.

What to consider when choosing a children’s nursery insurance policy

You will want to ensure that your chosen insurance policies suit your setting. Your nursery may be attached to a forest school; it is worth consulting with the insurance company to check if they cover for injuries and incidents involving forest school activities.

Customer service is important, and if the worst happens and a claim is made due to an incident in your nursery, or weather-related damage to premises, you want immediate support (some insurance companies offer a 24-hour helpline, which can give you peace of mind).

Some insurance policies are tailored to the size of your nursery and the number of staff in the team. Look carefully at a number of quotes to find the insurance policies that are right for you. Read the fine print on any insurance summaries; there may be exclusions to the policies that are important to be aware of.

For example, your public liability insurance may not cover the use of trampolines. Therefore your setting will have to decide if they want to change insurers or remove the use of trampolines from the outdoor area.

What are the most common claims in UK nurseries?

Children under the age of 5 are more likely to suffer an injury resulting in attending a hospital, making the children in your nursery more vulnerable than school-aged children. There are common injury and illness claims that nurseries experience. All of which can be prepared against through adequate training, policy creation and regular risk assessments.

Although your setting can be as prepared as possible, accidents can still happen. Here are the most commonly claimed for injuries in UK nurseries:

- Slips, trips and falls in and around the premises

- Choking on food or small objects placed in their mouth

- Allergic reactions (unknown reactions and known)

- Injuries due to premises maintenance (for example, uneven paving stones or carpet)

- Sudden infant death in nurseries, although rare it is a concern for nursery staff

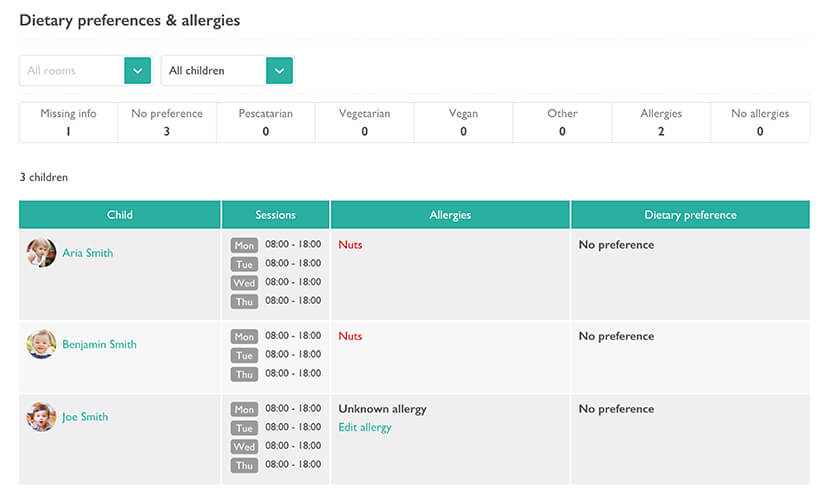

Reduce allergic or medical incidents at your setting to avoid a claim. With Blossom, dietary preference and allergy reports can be created to show all allergies in one place; there is even the option to filter by the children who are in during that session.