On the 30th of October 2024, the 2024 Budget was announced by Rachel Reeves (Chancellor of the Exchequer). The Autumn Budget revealed a 40 billion tax increase, necessary to ‘restore economic credibility and protect working people.’

One of the most notable changes is the forthcoming increase in employers’ National Insurance Contributions (NICs). As of 6 April 2025, the employer NIC rate will rise from 13.8% to 15%.

From a comprehensive glossary of industry-specific terms to expert guidance on preparing for the National Insurance Contribution increase in 2025, we provide nursery managers and owners with a complete resource covering everything you need to know.

With thresholds, allowances, and business rates all undergoing changes, a clear understanding of each aspect can facilitate more effective planning of your nursery’s 2025 budget.

Commonly used payroll and tax terms

National Insurance

National Insurance (NI) is the UK’s second-largest tax the government receives (income tax taking the top spot). NI is paid by employees and employers and funds social security benefits (like state pensions).

There are four main types of NI, known as Classes 1-4. Class 1 is the type of NI employers and employees pay, Class 2 is paid by those self-employed, Class 3 is for those who are not liable to pay National Insurance but want to contribute voluntarily. Class 4 is for those who have made profits above a set threshold and are self-employed.

Employees aged 16 and above, but below the national retirement age, must pay National Insurance (NI) contributions, which are calculated based on their monthly and annual earnings and are typically deducted from their monthly salary.

National Insurance Contributions

Both employees and employers must pay National Insurance Contributions (NIC), a percentage of earnings paid to the government. It is anticipated that NICS will yield the government approximately £170 billion in revenue for the 2024/25 tax year.

The National Insurance Contribution rate for the 2024 tax year is 13.8%. However, following the Autumn 2024 budget announcement in October, the NIC rate for employers is set to increase to 15% from April 2025.

Employers Pay Threshold

When employees’ monthly earnings exceed £758, they reach the existing annual £9,100 threshold, at which point employers become liable for National Insurance Contributions (NIC). The recent changes have lowered the employer’s pay threshold from £9,100 to £5,000 per year.

Employment Pay Allowance

The Employment Allowance is the figure for eligible employers to reduce their National Insurance liability by each tax year. In short, an eligible employer can claim the allowance to help reduce their National Insurance bill by the defined amount. The Employment allowance used to be £5,000 and will increase to £10,500 in April 2025.

Note: This may benefit smaller nurseries, the increased employment allowance will mean some employers might not pay NIC for up to four full-time employees (on National Minimum Wage)

National Minimum Wage

The National Minimum Wage (NMW) is the minimum hourly pay employees in the UK are legally entitled to. Depending on age and apprenticeship level, this pay baseline ensures that young workers training in apprenticeships receive a minimum hourly rate of pay.

- Apprentices’ NMW is £6.40 per hour

- Employees between the age of 16-17 will get £6.40 per hour

- Employees aged 18-20 will receive a NMW of £8.60 per hour

- Employees above the age of 21 will get £11.44 per hour (see National Living Wage below)

National Living Wage

The National Living Wage (NLW) was introduced in 2016 and updated most recently in April 2024.

This applies to employees working at NMW who are above the age of 21. The National Living Wage for 2025 is £11.44 per hour. This ensures that those working NMW positions above 21 receive more monthly pay than younger workers.

Business Rates

A nursery’s business rates are also known as national non-domestic rates, each private nursery that operates out of a non-domestic property will pay business rates (some church halls are excluded). Some nurseries may be exempt from paying business rates or benefit from a reduced business rate relief, but most private childcare providers will pay.

Business rates help to pay for the local services like fire, police and some waste management – although waste trade services are most likely a separate charge.

Business rates are calculated by multiplying your nursery property rateable value by the government-set multiplier rate. Currently, the rate for small businesses is 49.9p(companies with a property rateable value of less than £51,000). Standard business rates have 51.2p as their multiplier rate (companies with a property rateable value of more than £51,000).

To give you a real-life example, a 70-place day nursery in the North West of England has a rateable value of £31,500. As this will class the nursery as a ‘small business’, they will use the multiplier of 49.9p.

Their business rates to pay will be £15,718.50 per year.

There are government websites to help you find your nursery property value and calculate your business rates.

Business Rates Relief

Some businesses meet the eligibility criteria for reduced business rates, whereas most nurseries generally do not qualify under the current criteria.

Some businesses, like retail, hospitality, and leisure, are eligible to pay reduced business rates. The local authority decides it. This is why some childcare provisions using church halls may fall into this category; it is worth contacting your local authority to check if your provision fits the criteria for rates relief.

You can find more information on which settings are eligible for business rate relief here.

A summary of the latest changes to National Insurance for nurseries

In short, rates, thresholds and contribution amounts have increased, decreased or stayed the same. As clear as mud! Let’s make it easier to digest so you are aware of the changes and how they will affect your nursery – this is particularly important if you are looking to move into nursery management in the near future.

Increasing:

- National Minimum Wage increased in April 2024 to £11.44 per hour for those 21 and over

- The amount employers can claim each tax year (Employment Pay Allowance) has increased from £5,000 per tax year to £10,500

- National Insurance Contributions for employers are increasing to 15% in April 2025 (from 13.8%)

Staying the same:

- Income tax

- Employee National Insurance Contributions remain at 8% (if earning between £1,048-£4,189 per month)

- VAT

Decreasing:

- The threshold for when employers begin to pay NIC has lowered from £9,100 to £5,000

- The NI liability threshold of £100,000 per tax year has been removed, meaning all businesses can now claim the Employment Pay Allowance of £10,500 per tax year

How will the NIC changes impact nursery managers?

Any increase in employee wages or required contributions will result in higher outgoings for your nursery. As the government’s expansion of childcare funding is expected to cover 70-80% of all childcare places in England, the viability of this arrangement relies heavily on the funding rates.

Many managers are concerned the only way they will survive the increased outgoings will be to raise parent fees. With the Labour Party’s focus on education and their goal to raise standards and access to high-quality childcare a priority – an increase in funding rates to allay the increase in outgoings is essential.

How to prepare for increased nursery outgoings

When optimising your nursery’s spending, you must look at your profitability margins. With the increased costs surrounding NMW and NIC, you must have a solid understanding of what your nursery must make and how many spaces you must fill each day, week and month to stay profitable.

Nursery managers are looking at all things budgets, where they can cut back and untapped income opportunities they may have overlooked.

You can download our free nursery manager’s ultimate guide to budgeting to get you started.

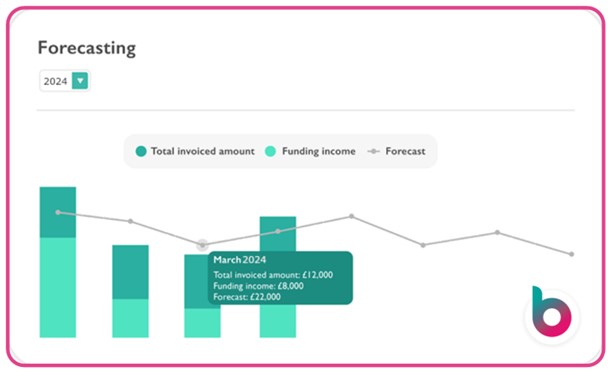

When you have access to your financial forecasts and current financial position, it becomes less daunting to see the impact external changes can have on your business.

Predictive analytics is a term for number-crunching with purpose. We recommend you have a look at our article on how to increase your setting’s efficiency and profitability.

Speak to professionals for advice on the upcoming outgoing changes. Discussing your options and forecasting with a financial advisor can help settle any concerns and give you the knowledge boost to tackle your budgets and finances confidently.

Evaluate how you are making the government funding work for you, analyse your current childcare packages to see where you have reasonable room to increase prices for consumables or activities.

Stay up-to-date with the latest news and updates from the Department for Education (DfE), Ofsted, and other relevant EYFS legislation through our regularly updated blog.